David Pawelkowski

Head of Operations of Zadig Asset Management

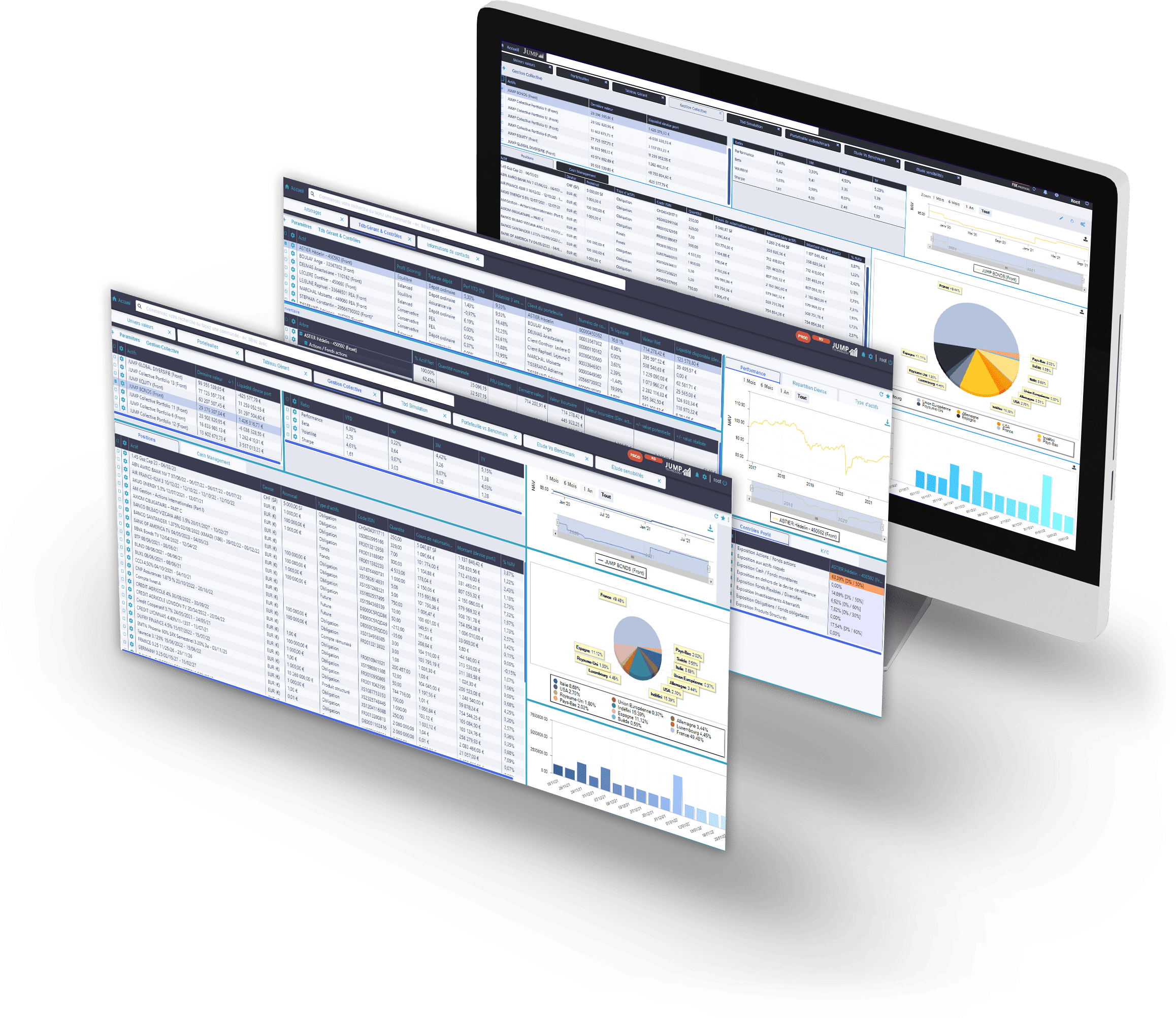

JUMP's Front-to-Back software not only allowed us to meet our data consolidation needs within a single solution, focusing on Front Office activity, but it also gave us the freedom to control and modulate the software according to our needs.

Read more >

Romain Burnand

Founder of Moneta Asset Management

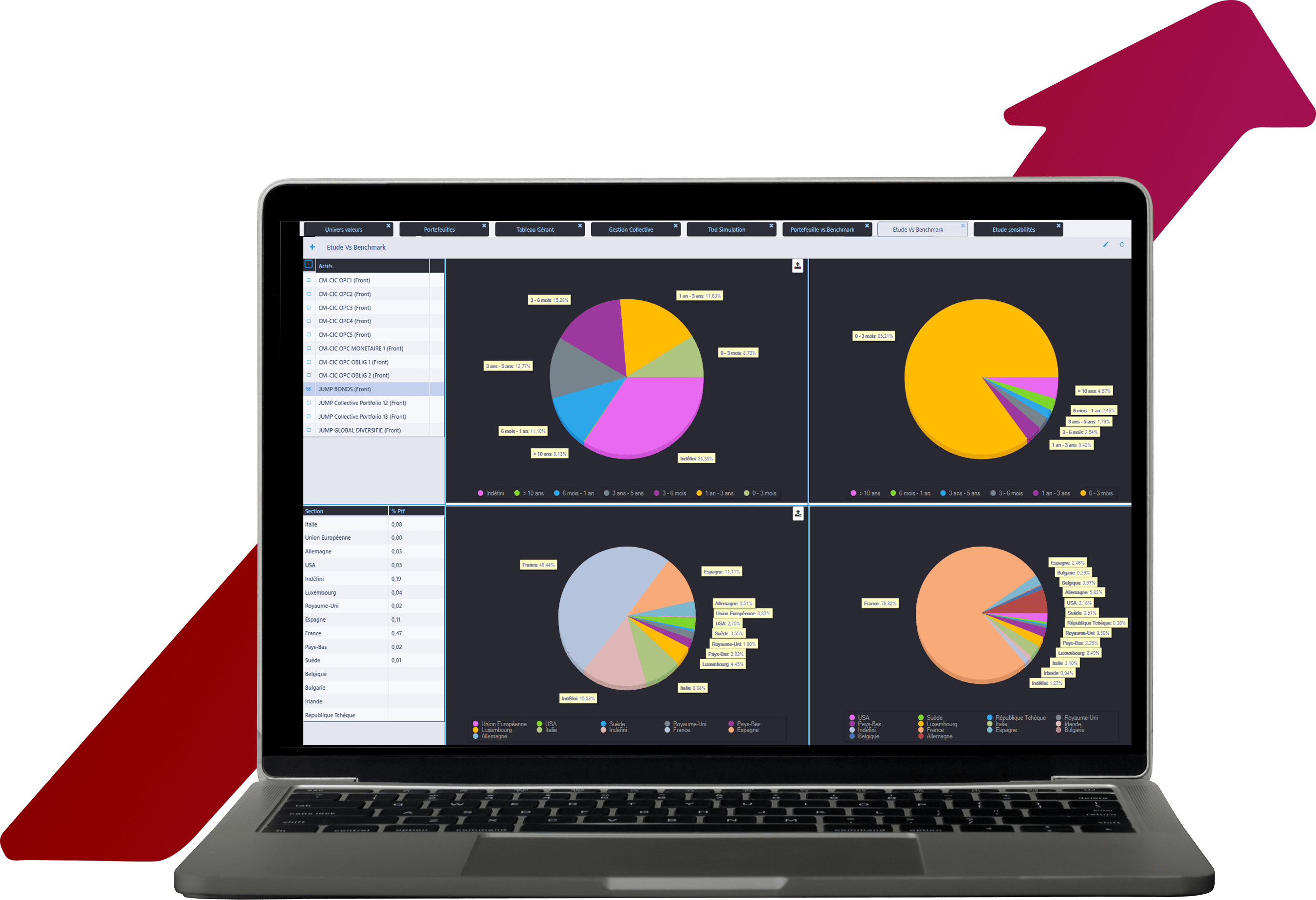

Considering the strategic importance of this project, we have chosen not only the software package, but also the team, that we felt was best suited to meet our needs.

Read more >