Vincent Rasclard

Managing Director of Rothschld & Co Asset Management Europe

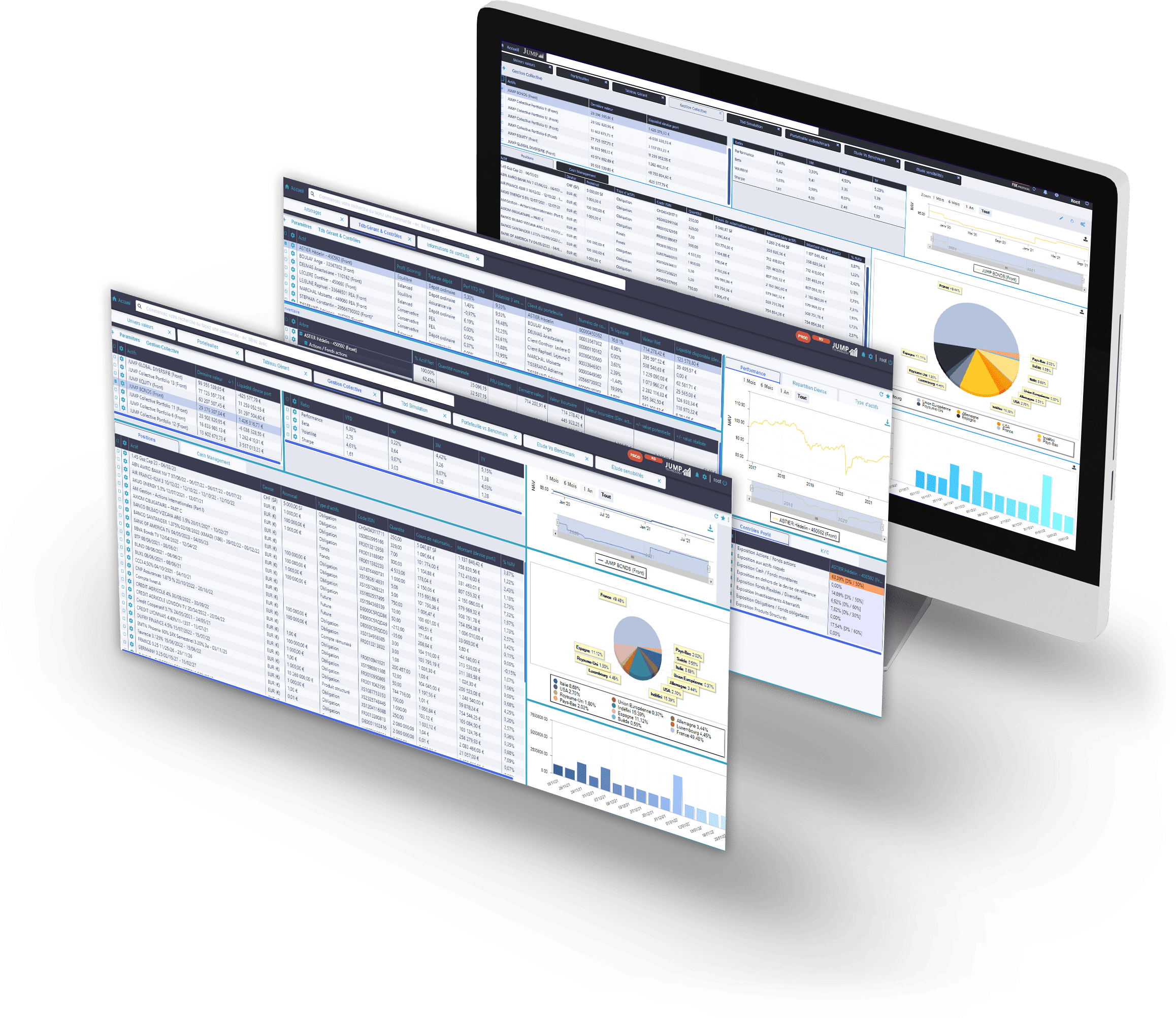

"We have already seen significant productivity gains in our reporting department thanks to the JUMP Platform. The Fixed Income Attribution module allows us to enhace our service offering for our institutional customers."

Read more >

Alexandre Lengereau

President and Cofounder of Amadeis

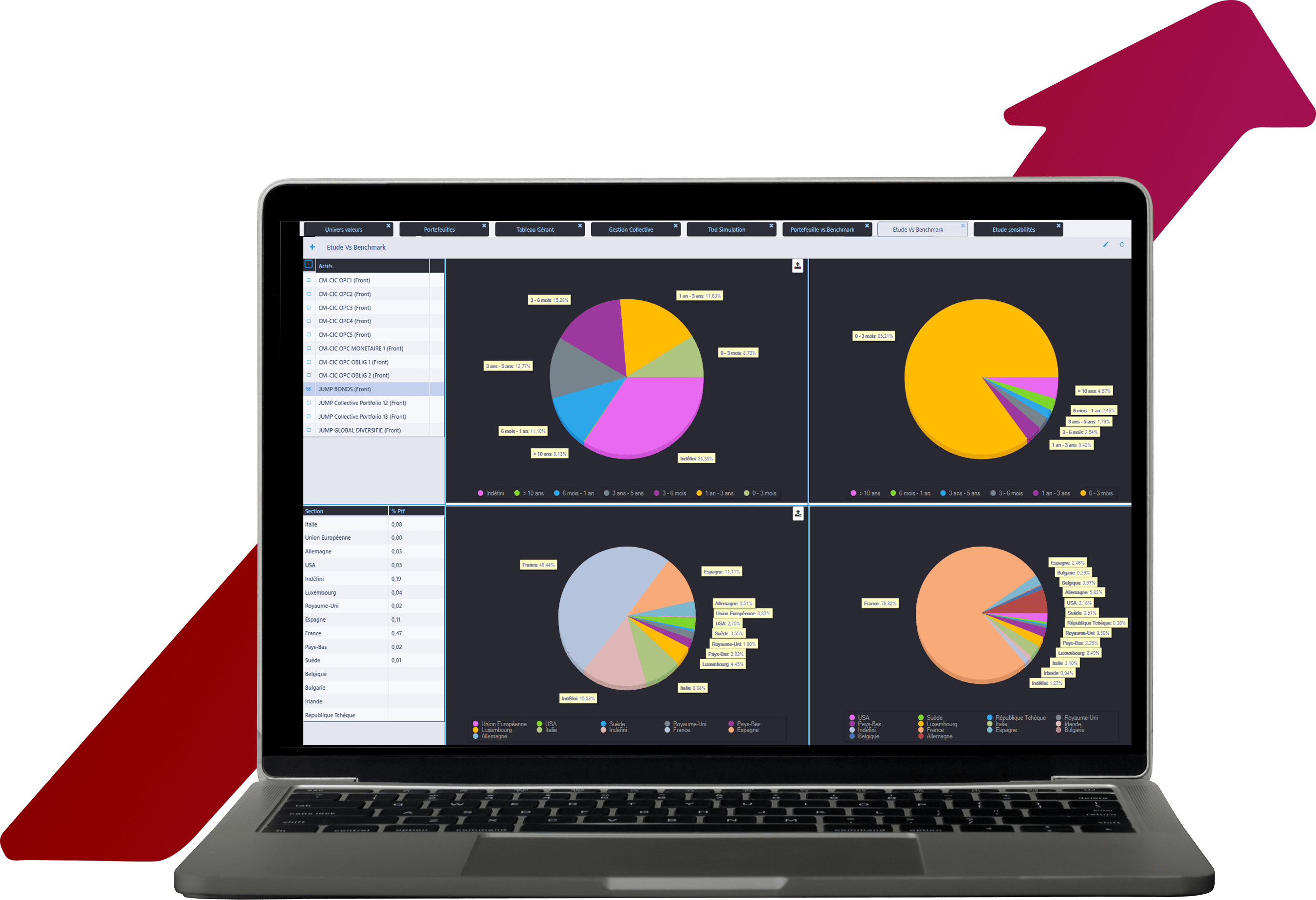

The richness of its Reporting features, as well as its capacity to cover other needs (data management, performance calculation, retrocessions, etc.), were what made JUMP stand out compared to other Reporting solutions on the market.

Read more >