In the words of Rim Bensouda, Head of Asset Management

PROJECT SCOPE:

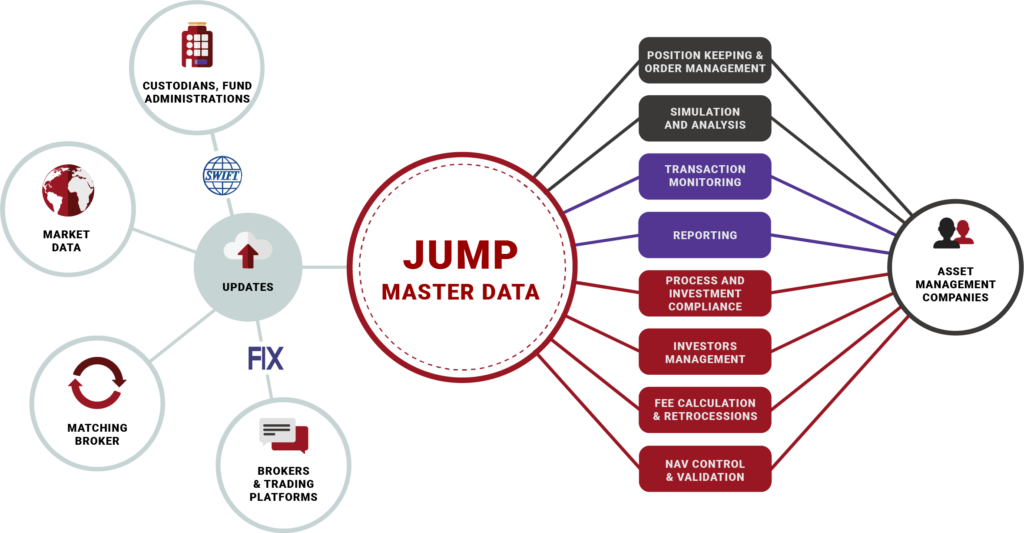

Data Management ► Portfolio Management ► Order Management ► Pre- & Post-trade Compliance ► Risk & Performance ► Portfolio Administration ► Reporting ► Digital

The Saham Group is an African-based investment company, historically active in essential human services and businesses. Characterized by a strong entrepreneurial spirit, Saham first developed in the insurance industry to become the leader in this industry on the African continent.

After the sale of its Insurance division in 2018, Saham became an international player with multi-sector expertise capitalizing on targeted strategic partnerships spanning the offshoring, real estate, education, and agriculture industries.

INDUSTRY PLAYER: Familly Office

HEADQUARTERS: Morroco, Casablanca

SAHAM Management Company (SMC) is the investment management subsidiary of the SAHAM Group. As responsible and multi-sectoral investors, we have invested in a logic of long-term value creation for listed assets (stocks, bonds, mutual funds, structured products, etc.) and unlisted assets (real estate, etc.).

We manage a portion of our investments directly and delegate the other portion to partner investment management companies through mandates. We operate in an open architecture with multiple custodians.

Given our growth, we were looking for a solution capable of automating the consolidation of data from a growing number of custodians and investment management companies, covering all our investment management needs, and automating the production of custom reports.

The solution we were looking for had to allow us to meet the following requirements:

“The JUMP platform covers all of our needs, including those specific to the Moroccan market, and provides us with a sustainable, scalable, and adaptable solution, capable of supporting us in the long term.”

Rim Bensouda, Head of Asset Management of Saham Management Company

► Customizing and adapting the solution to our needs

In addition to covering our requirements, the JUMP solution stood out because of its intuitive ergonomics and strong customization capabilities, including design tools for business users, thus enhancing the user experience.

We have strong growth objectives. Thanks to JUMP, we will have the ability to handle new needs and increasing volumes of data, while continuing to automate our management operations to the greatest extent possible. Our teams will be able to focus on driving business through custom dashboards and reports, exception handling, and high-value-added tasks.

► Why JUMP?

We selected JUMP first and foremost because the solution covers all of our needs within a single platform thanks to its functional richness, enhanced connectivity, and ability to support the specificities of the Moroccan market.

We also chose JUMP because it provides us with a perennial, scalable solution, capable of accompanying us over the long term.

Finally, the responsiveness and proximity of the teams at JUMP, right up to the Top Management, are greatly appreciated when it comes to successfully completing a project that impacts our core business.

“JUMP is delighted to be working with SAHAM Management Company, a leading industry player in Morocco with a strong presence on the African continent and throughout the world. This project demonstrates both the ability of our software solution to cover the specificities of the Moroccan market and JUMP Technology's willingness to establish itself within the Moroccan market and, more generally, on the African continent.”

Emmanuel Fougeras, CEO of JUMP Technology